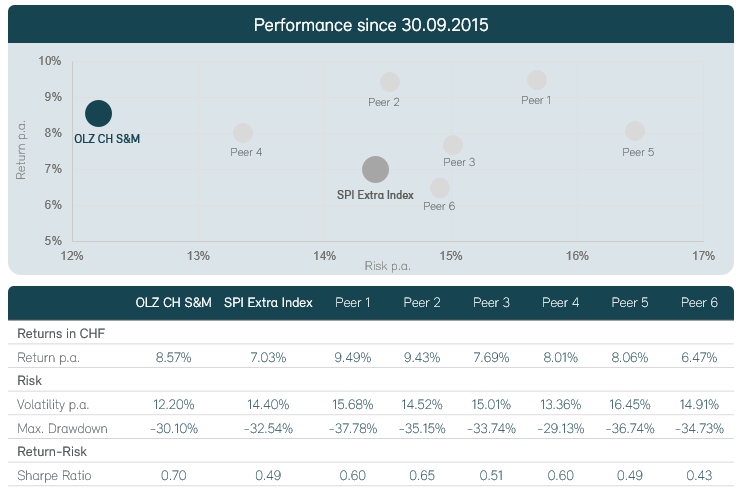

The OLZ Equity Switzerland Small & Mid Cap Optimised ESG fund has been running for more than two years and has already grown to over CHF 100 million.

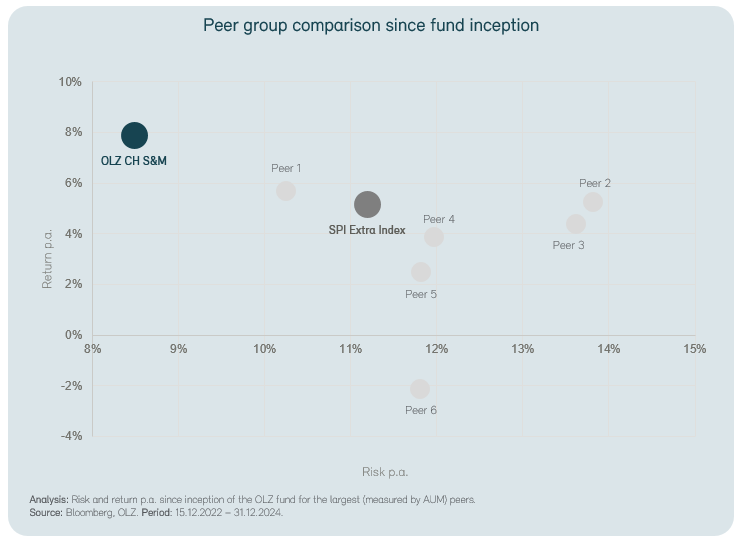

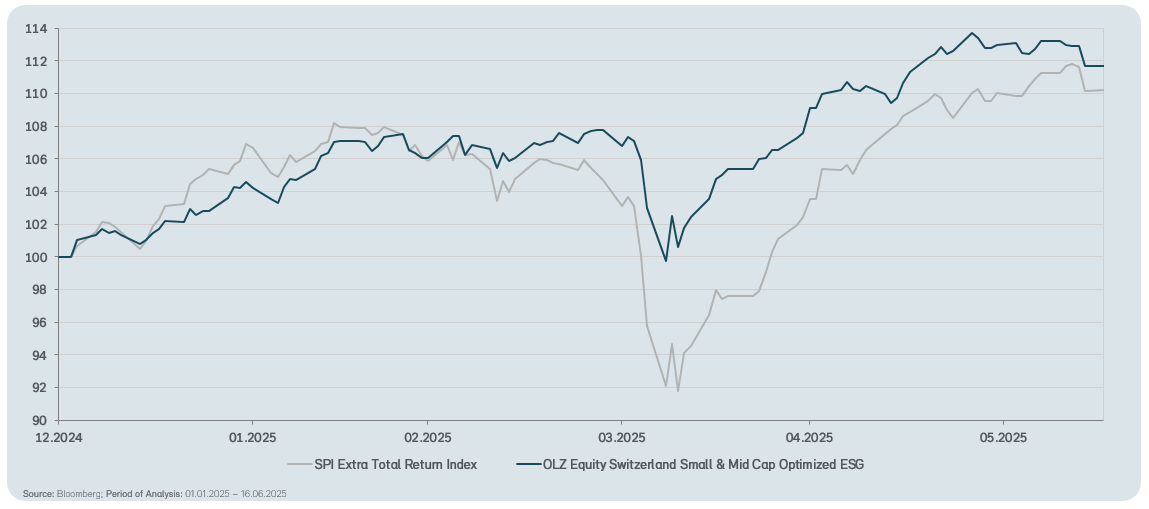

Since its launch, the fund has achieved a solid outperformance of 2.5% p.a. compared to the SPI-Extra, clearly outperforming the benchmark. The OLZ fund also outperformed the largest funds in the Swiss small and mid-cap equity segment, both in risk-adjusted and absolute terms.

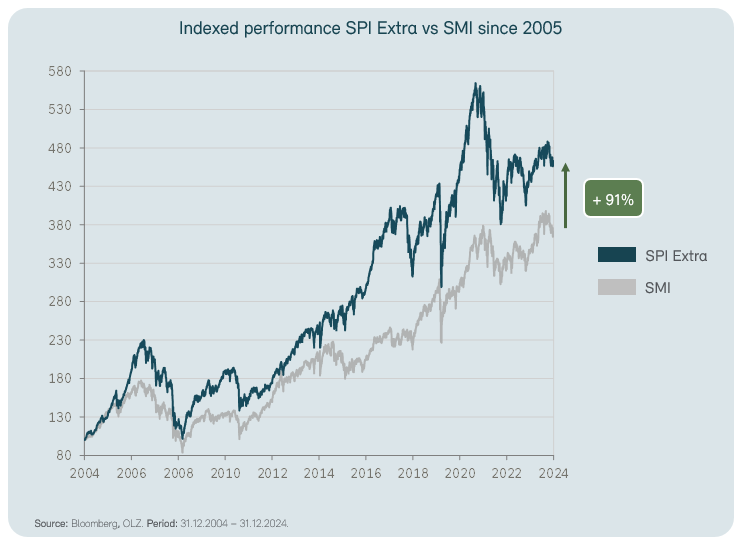

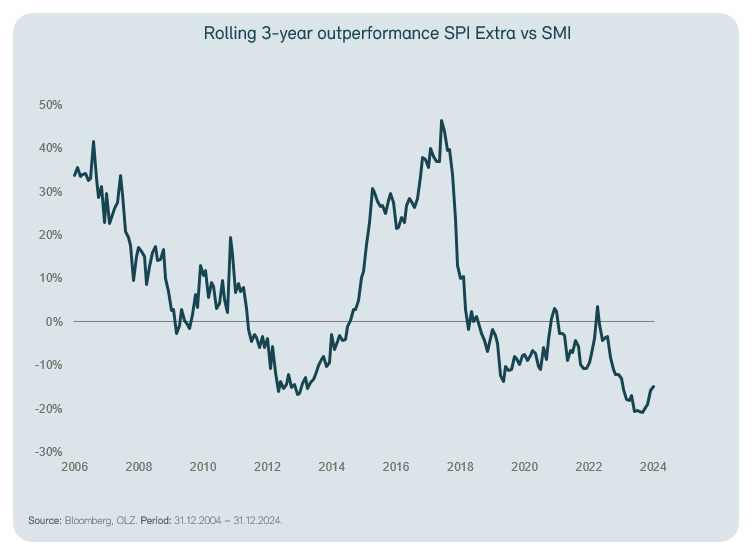

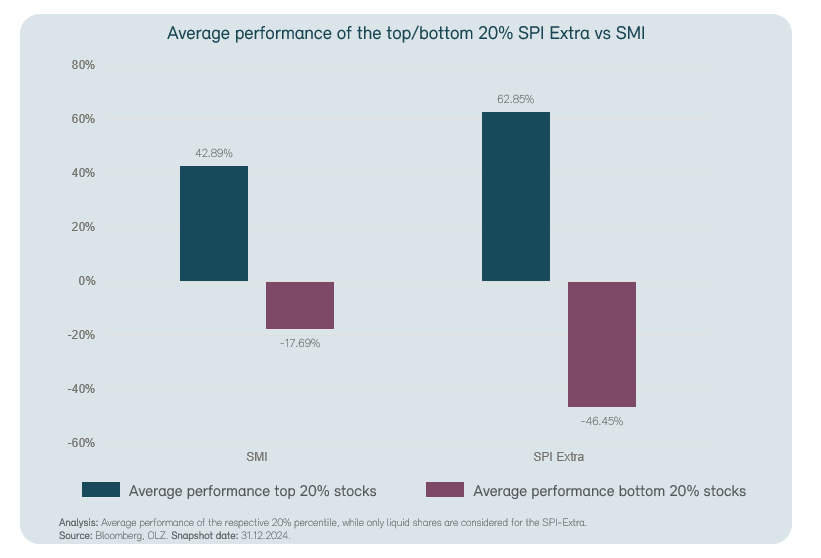

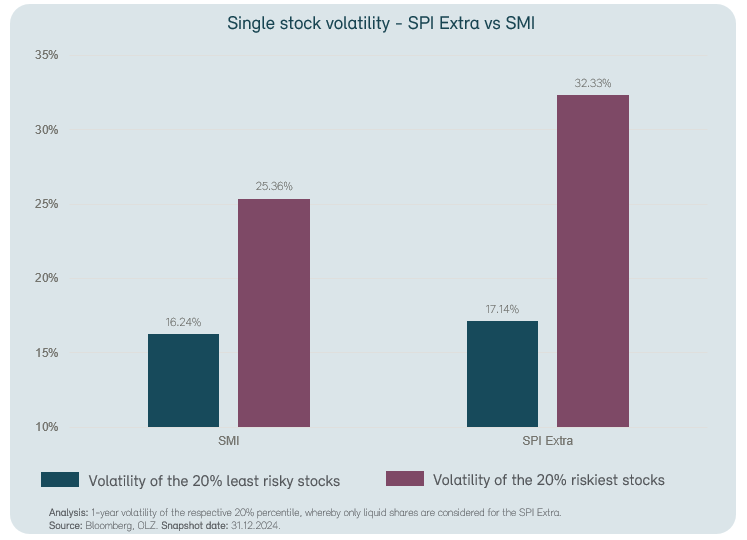

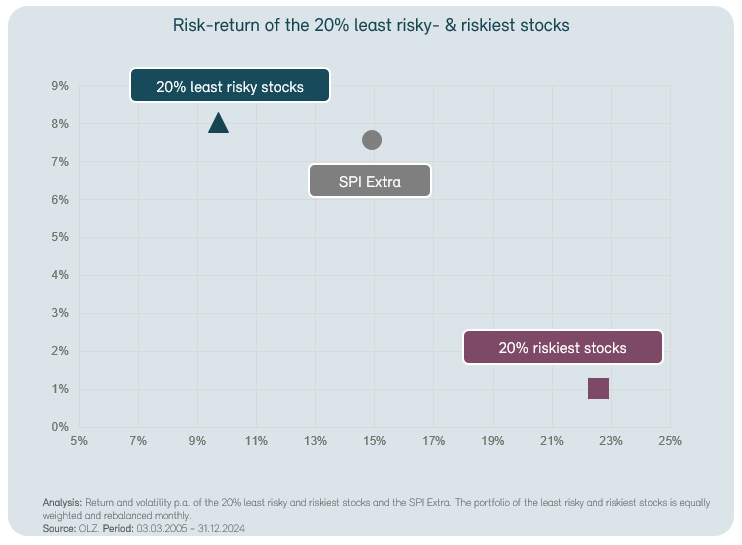

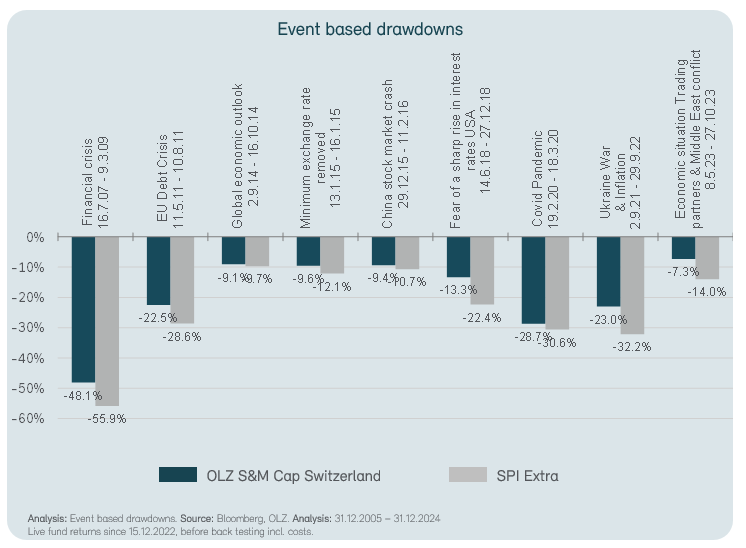

The OLZ risk optimization delivers significant added value in the small and mid-cap universe, which is structurally exposed to significantly higher risks (volatility and drawdowns).